The Efficiency Purge: Why the 2026 Labor Market Feels Like a Recession

The headline numbers say the economy is good. The experience of millions of workers says otherwise.

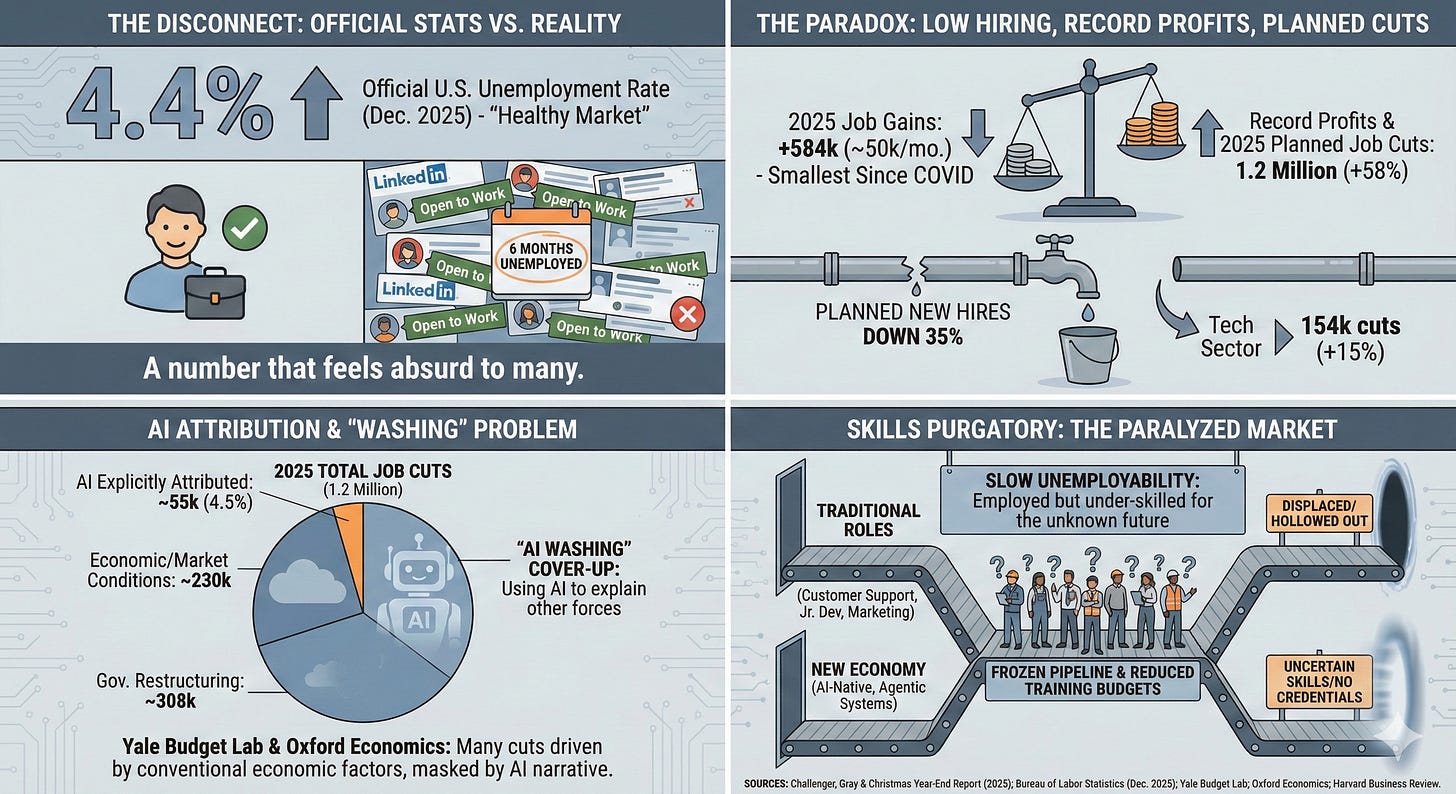

The official U.S. unemployment rate stood at 4.4% as of December 2025, the highest level since 2021, but still within what economists would consider a healthy labor market.

It is a number that feels almost absurd to anyone who has spent the past year watching their LinkedIn feed fill with “Open to Work” banners, watching peers go six months between interviews, or watching entire teams disappear from companies that are still posting record profits.

The disconnect is real and measurable. The official unemployment rate tells you how many people don’t have a job. It tells you nothing about how few jobs are being created or how frozen hiring has become. To understand the 2026 labor market, you have to look beyond the headline to the underlying data.

Start here: the U.S. economy added approximately 584,000 jobs in all of 2025. That is roughly 50,000 per month, which is the smallest annual job gain since COVID and the slimmest yearly increase since 2003. Meanwhile, employers announced 1.2 million planned job cuts in 2025, up 58% from 2024 and the highest annual total since the pandemic. Long-term unemployment is at a four-year high. Planned new hires announced by employers were down 35% from 2024, the lowest level since 2011.

This is not a recession by the traditional definition. But for white-collar workers, particularly in tech, software, marketing, and customer-facing corporate roles, the conditions are indistinguishable from one.

The Layoff Wave

The most visible driver is a wave of corporate downsizing led by some of the world's most profitable companies. Amazon eliminated approximately 30,000 corporate roles since October 2025, or about 9% of its corporate workforce. It linked those cuts publicly to AI-driven efficiency and management delayering.

Salesforce cut more than 5,000 positions across two rounds, with its CEO explicitly attributing the reductions to AI agents taking over customer support and sales functions. Meta, Block, HP, Microsoft, and Pinterest have all announced significant cuts in recent months, citing AI investment and efficiency as the rationale.

The tech sector alone announced 154,000 job cuts in 2025, up 15% from 2024. October 2025 was the worst single month for announced layoffs in more than two decades. The ripple effects have spread well beyond tech: UPS announced 30,000 cuts partly in response to reduced Amazon shipping volume. The cascade is real.

The AI Attribution Problem

Here is where the narrative gets more complicated. AI is unquestionably an active force in the current labor market. Consulting firm Challenger, Gray & Christmas tracked nearly 55,000 U.S. job cuts in 2025 that companies explicitly attributed to artificial intelligence, a figure that will grow in 2026.